In the 2024-25 academic year, the CEFAR Academy has secured 52 projects from 22 sponsor organizations. Under the “Fintech 2025” strategy, Hong Kong Monetary Authority (HKMA) has launched the Industry Project Masters Network (IPMN) scheme with the aim of grooming fintech talents by providing opportunities to postgraduate students to work on banks’ fintech or industry projects and gain hands-on experience and skills. Out of the 52 projects secured in 2024-25 academic year, 10 are offered via HKMA IPMN scheme, soliciting the support from 5 sponsor organizations.

The scope of the applied research projects are categorized by Technology Domains and Business Domains respectively as follows:

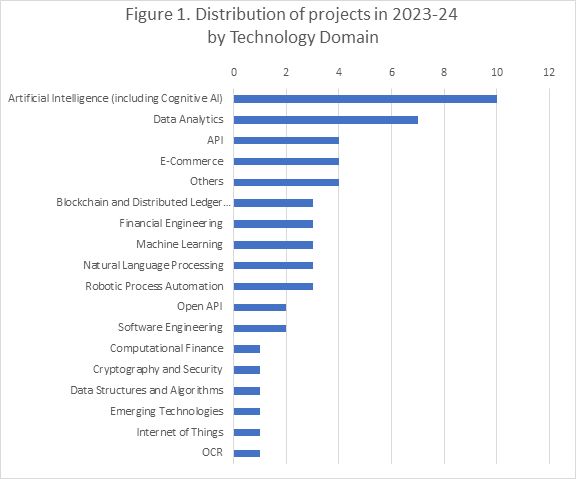

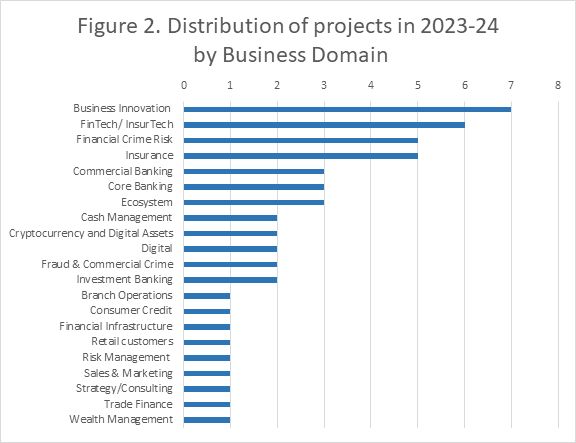

In the 2023-24 academic year, the CEFAR Academy has secured 71 projects from 42 sponsor organizations. Under the “Fintech 2025” strategy, Hong Kong Monetary Authority (HKMA) has launched the Industry Project Masters Network (IPMN) scheme with the aim of grooming fintech talents by providing opportunities to postgraduate students to work on banks’ fintech or industry projects and gain hands-on experience and skills. Out of the 71 projects secured in 2023-24 academic year, 16 are offered via HKMA IPMN scheme, soliciting the support from 11 sponsor organizations.

The scope of the applied research projects are categorized by Technology Domains and Business Domains respectively as follows:

Completed Projects in 2023-24

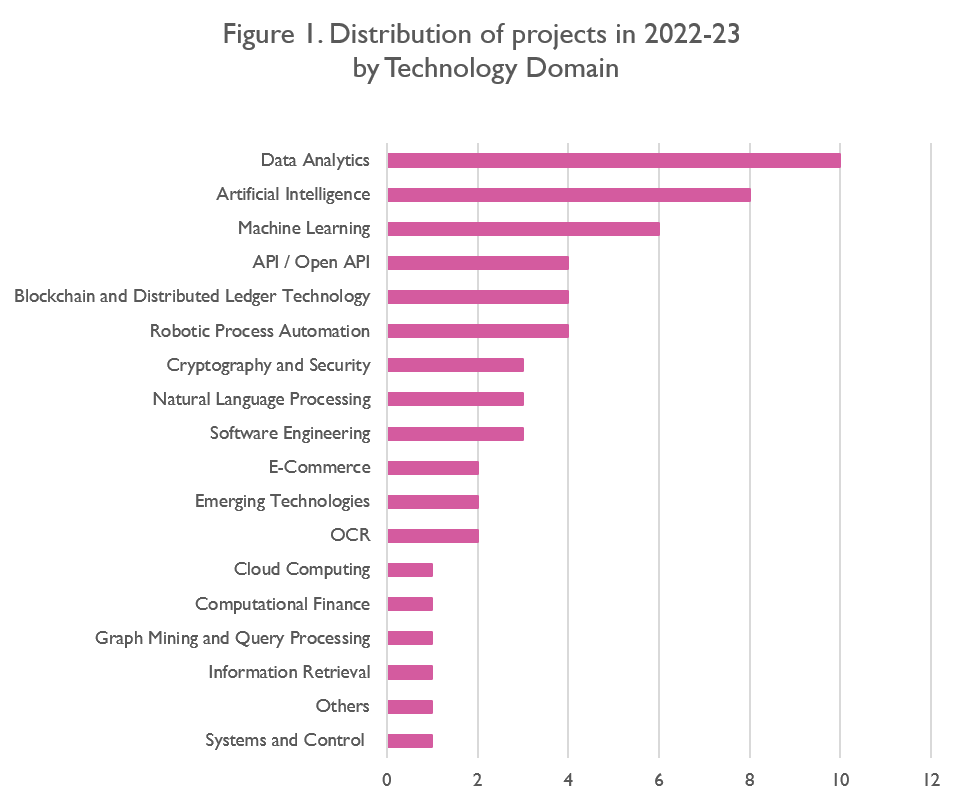

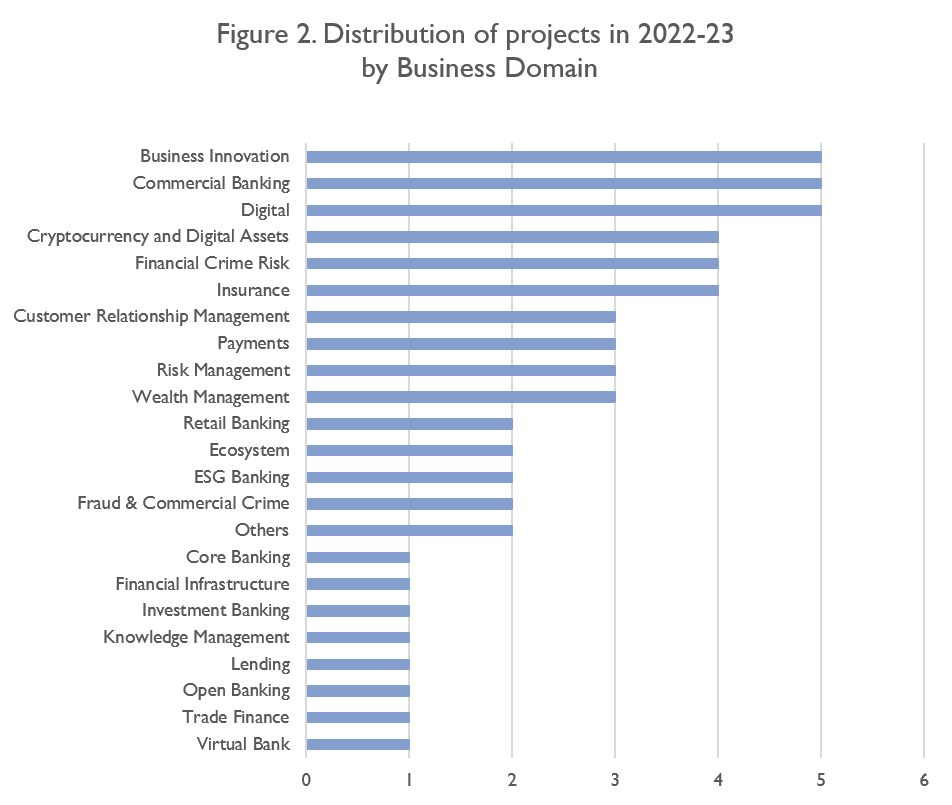

In the 2022-23 academic year, the CEFAR Academy has secured 57 projects from 30 sponsor organizations. Under the “Fintech 2025” strategy, Hong Kong Monetary Authority (HKMA) has launched the Industry Project Masters Network (IPMN) scheme with the aim of grooming fintech talents by providing opportunities to postgraduate students to work on banks’ fintech or industry projects and gain hands-on experience and skills. Out of the 57 projects secured in 2022-23 academic year, 24 are offered via HKMA IPMN scheme, soliciting the support from 17 sponsor organizations.

The scope of the applied research projects are categorized by Technology Domains and Business Domains respectively as follows:

In terms of Business Domains, the scope of the applied research projects are categorized as follows:

Completed Projects in 2022-23

Completed Projects in 2021-22

Completed Projects in 2020-21

Traditional retail stores are also expanding their business by O2O. This project researches and analyzes the consumer and merchant behavior on mobile POS collection and create a user friendly journey, designs and customer/merchant adoption strategy of the new POS solution. This will enhance the current POS solutions for online merchants to receive payments from consumers / personal customers

A secure digital identity system is needed as the foundation of digital transactions. This project adopts iAM Smart function and develops a website. iAM Smart log-in integration is completed. Next stage can perform an online application form submission. This project helps develop iAM Smart system into a globally recognized identity certification system for individuals and organizations, and promote securely digital transactions and contracts.

The HKMA issued 8 licenses of virtual bank in 2018. The virtual banks will grow up in tough soil and hard to survive due to the competitions from the existing strong incumbents in Hong Kong and strong regulatory. This project is to suggest virtual bank a way to success in Kong Hong and expand it to the oversea markets.

Today banks make money from net interest margin as well as from fees. With central bank interest rates nearing zero in many markets, these margins are getting squeezed. Indications suggest some markets will go below zero. This project identify the target customer group, determine the pricing, fractional investing threshold, fractional investment product types, and develop a front-end prototype. This project results the fractional investing concept to bundle with digital retail payments, using the round-ups of digital retail payments to make fractional investment.

Individual investors are lack of professional guidance of crypto-assets investment. This project designs a Trading Strategy Platform to orchestrate these solutions of both traditional and alternative financial instruments. Investors able to know well about their own investment goals, horizons, risk profile and preferences when they choose trading strategies.

The traditional AML techniques used by most banks doesn’t account for funds laundered through networks of individuals in smaller, non-rounded dollar amounts to avoid detection. This project produces a literature review on the necessity of anti money laundering and related research on social network analysis. It helps to reduce a huge amount of manual efforts to investigate AML cases one by one.

With the “Open API Framework for the Hong Kong Sector” launched by HKMA in July 2018, it is needed to ensure competitiveness and relevance of the banking sector under a secure, controlled and convenient operating environment and ecosystem. A research is conducted to explore solutions for addressing these generalized issues for Open Finance, specifically in the context of cryptocurrencies trading services domain, which can be seen as a part of the future Open Finance arena.

Competition among the banking industry in Hong Kong is bound to intensify, so it is crucial to use big data technology customer relationship management (CRM) to enhance a leading bank's competitiveness. This project designs a CRM system which focuses on integrating and analysing public information and has the alert function. RMs will spend less time collecting and consolidating information related to customer relationships, which results in higher CRM efficiency.

Gen Z has gradually become the main force in the Hong Kong consumer market. This project is to attract new-to-bank customers for a major bank credit card management APP and improve user experience through new technologies. It benefits customers to get cash rewards which also benefit the application to keep users stay and enhance the user experience.

With the rapid development of the Internet today and modern consumers are pursuing interesting platforms, traditional banks need to digital transform. The project conducts literature review to provide a solution using the charity WeChat mini-program combined with open banking to do the bank's fun innovation and build connections between the Bank and their dynamic customers. This project demonstrates a fun mini-program can make a bank's information flow between customers through open banking API, achieving dynamic customer engagement.

Due to the lack of investment vehicles like passive funds in DeFi, digital asset traders now do not have this trading option to execute the diversification strategy in managing the risk of their portfolios. This project develops a hybrid neural network named three-filter network (3FN) for predicting the next 30 minutes’ return of the crypto and hence to point its future movement. It enables digital assets traders for risk diversification.

This project introduces option to cryptocurrency markets. It develops a DApp where users can deposit any of the ERC20 tokens supported within the DApp and automatically issue governance tokens as rewards to liquidity providers. Hegic protocol using smart contract on ethereum to allow option trading on cryptocurrencies without central clearing organization.

With the growing popularity of the mobile Internet and the epidemic situation, the demand of personal financial management in recent years are increasing rapidly. By conducting market research and questionnaire interviews on potential customers, and build a PFM app prototype based on Python, Qt and SQLite.

More people want to invest in cryptocurrencies, market development is relatively early, many products stay in the early stage and cryptocurrency exchanges are open 24 hours a day. This project aims to develop a Crypto Asset Data Management System, including the extraction of crypto asset data and storing it to the cloud server and unifying the different formats of various crpto assets. It helps better deploy quantitative trading strategies for cryptocurrencies in the market.

With the increase of digital transformation in the banking industry, the weak protection of online banking business process data privacy, and the user experience needs to be improved. This project investigates the pain points of user identity authentication in data privacy protection and user experience development, explore its development in this area and propose feasible solutions. It improves the user experience while ensuring effective identity authentication.

Young people in Hong Kong not being educated and lack of motivation to manage their personal finance. This project is to find out the financial / investment related mobile App user’s behavior in Hong Kong and propose a new financial / investment App for the Bank. It helps to understand the background of the Bank target segment, the mindset of target segment by knowing their preferences and interests on the detailed design of the future financial / investment App.

In emerging markets, it’s a challenge to deal with the reported data and statistics especially sector performance metrics, because such data is often delayed, biased, outdated, or even inaccurate. This project focuses on better proxy for unemployment in India. It helps the bank to estimate sector performance.

Social media network, blogs and other online media are saturated with valuable customer data that the bank can use the data content to predict customer behavior and to improve the marketing and client experience across digital channels. Leveraging advanced analytics and external data to further unlock the value of internal data to better customer profiling and need for offering a right product or action recommendation timely. A single desktop application integrated with a automatic customer profile generation application, a credit score tracking application and a product recommendation system.

Completed Projects in 2019-20

The presence of adverse news, social media feeds and online blogs may heavily influence a business’s reputation and momentum. A solution is depicted to assess the external impact to respective business lines. The solution can categorize social media and news feeds into respective business lines and assess the relative impact using predefined rating system. This will serve as a data point for audit risk assessment.

Cyber security risk remains a huge threat in the banking industry. Auditors will be required to visit multiple websites to keep themselves updated with cybersecurity news and threat intelligence information, which proves time-consuming. A solution will be illustrated to automatically claw relevant information, categorize them into different buckets, assign a risk rating and a relevancy rating to the news and provide dashboards to highlight the trends and key focus items. The solution can then automatically prompt auditors to take actions.

Compliance with different regulations is very challenging for banks that have presence across the globe. Regulations are also frequently revised to manage the risk of impacting financial stability. Auditors will require extensive periods to read through the regulations and map against the defined audit scope. A solution is depicted that categorizes the regulatory requirements into different risk types, business segments and auditable entities. It is also capable of performing sanity check on the coverage of regulatory requirements against audit plan.

Customers experience a lot of friction while conducting banking services in traditional banks. Services are siloed for banking apps and websites. There are limited touchpoints between business and customers and the offered products present with insufficient customer-centric design. A solution is illustrated to build a more efficient market for customers and corporations. Digital products and experiences will need to be brought to a new frontier and a brand-new business model curated to keep up with the competitive market.

Current investment robo-advisory is bounded by regulatory constraints and is limited to ‘risk appetite screening’. However, customers still face a few issues, including: the inability to receive a proper portfolio advisory via A.I. in mobile; easy logic that every layman customer can understand and invest at ease; develop different profiles from machine learning technology so that every customer can receive a calculated investment plan to create a sensible formula; and the need to fully comply SFC and HKMA. A solution is illustrated to address these issues so that everyone can enjoy these dedicated services.

A solution is illustrated to determine how social media influences the trading trends by analyzing historical data, social media news, posts on celebrities and famous investors. It can also captures customer’s search records, transaction pattern for analysis. It can provide predictions to traders, RM and customers based on new social thread and recommending customer-centric investors’ news for customers.

Technological advancement has allowed us to be more flexible, enabled and connected than ever before. Currently, workplace accessibility is still siloing, with the inability to maximize the usability across systems and facilities. There is also a lack of streamline management on internal and external administration, plus not able to serve ad hoc utilizing purpose. Physical office environments are now mixed with or replaced by remote and flexible workplace experiences. Staff still requires assessing systems manually. A solution is illustrated to provide a user-friendly, visual and interactive experience that makes implementation and adoption easy so we can determine our ROIs.

The emerging concern on intangible cultural heritage reflects the fear of diminishing cultural diversity and human creativity. These assets require prompt preservation. With digital transformation, a solution is introduced to provide an interactive platform to promote this heritage. By building a blockchain/DLT based community, this allows ICH expertise to share their profile and attract any potential investors for preservation. The use of VR/AR technology will provide a distant learning experiencing that allows individuals to learn about the legacies. Transforming the ICH techniques into disruptive ideas will help extending sustainability opportunities.

Based on the research on the game market and wealth management market in Mainland China and Hong Kong, determine the future development prospects of wealth management games and players’ preferences and needs for wealth management games. An evaluation model can be used to distinguish whether the game can be successful is obtained, and the game design and testing are carried out according to the model elements.

In recent years, many consumers have embraced the switch from traditional banking methods to digital banking. There is increasing demand for speed and convenience, and the timely and personalized provision of products and services to every consumer. A solution is illustrated to build an interactive platform for lifestyle banking, by providing offers, exchange e-coupons, rewards and exclusive privileges to customers. Within the platform, there will be a built-in human-like robot that can handle basic interaction. Together with self-learning algorithm, it is hoped that each customer can shape their friendly assistant which matches their own personality.

Digital Transactions all require ID&V to a certain extent. University students play an integral component as customers for origination, and in the digital economy, manual checking of ID remains less feasible in terms of customer experience and turnaround time. A solution is depicted that proves to be more efficient and robust, enabling a straight through customer journey without the need for manual check.

Open Banking is a driving force of innovation in the banking industry. By relying on networks, it can aid customers to securely share their financial data with other financial institutions. A solution is introduced to develop a browser app of the consumer side based on the OB standard and create an account or network dashboard that aggregates the customer’s account information amongst other banks.

Customer research and design thinking are critical in creating effective mobile customer experiences. A sticky app should be able to understand its users, solve a problem, user-friendly and personalized and visually appealing which creates long term engagement and growth. As university students form an important segment, research is needed to understand their needs and what rewards the app can offer to promote its use.

With the use of a predefined set of Fintech categories, a solution is illustrated to build a live public linked reference page that shares existing codes for a variety of apps developed and shared with open-source licenses. This drives education among developers new to Fintech and accelerates solutions in Hong Kong.

Developers find it difficult to identify the right APIs for the applications they build. Banks find it difficult to find applications that can use the existing APIs creatively. A research is conducted to investigate a solution that enables an API’s repository such as openlab to match the needs of an app to the APIs available. This enables developers to move faster and build more customer centric solutions.

Many government departments have traditional manual and expensive ways of providing access to records or data. This costs the taxpayer money and frustrates those who need fast access to records. A solution is illustrated to develop use cases that the digital team at the bank could build and offer as a service to HK citizens to reduce time and save money for both the government and the citizens.

The Guangdong-Hong Kong- Macao Greater Bay Area is an area that has received great attention in development. The objectives are to further deepen cooperation amongst Guangdong, Hong Kong and Macao, facilitate in-depth integration within the region, and promote coordinated regional economic development, with a view to developing an international first-class bay area ideal for living, working and travelling. Research will be conducted to investigate the Chinese market and develop a new platform targeting cross border travelers that will provide products and services appealing and retaining such users.

Nowadays, traditional banks deliver their products and services via different physical branches and telemarketing or digital channels. This allows them to cross sell their products and services to their existing customer base and the acquisition of new customers via below the line and above the line marketing activities. A newly established virtual bank would experience difficulties without any physical branches and strong customer base. A solution is investigated to allow virtual banks to tackle this issue.

A solution is illustrated to enable the development of an efficient scholar system that allows the exploration of valuable scholars and development in specified areas. This helps users to locate top scholars in their respective fields and extract information more efficiently. It can also aid companies to connect to talents who have outstanding contribution in their fields and simplify the recruitment process.